Alfred Rappaport 7 Value Drivers

Implementing Shareholder Value Analysis • • • Updated on: November 16, 2007 / 5:26 PM / MoneyWatch Shareholder value analysis (SVA) is one of several nontraditional metrics being used in business today. SVA determines the financial value of a company by looking at the returns it gives its stockholders and is based on the view that the objective of company directors is to maximize the wealth of company stockholders. What You Need to Know How is shareholder value calculated? Shareholder value is calculated by dividing the estimated total net value of a company based on its present and future cash flows by the value of its shares of stock. The resulting figure indicates the company's value to stockholders. Why adopt SVA?

Download film pirates 2005 indowebster. Feb 1, 2018 - Alfred Rappaport 7 Value Drivers. A Guide For Managers And Investors Alfred Rappaport. Short reg Value Driver Assessment A value audit enables managers to monitor overall value creation. A business unit value driver analysis is.

The underlying principle of shareholder value is that a company adds value for its stockholders only when equity returns exceed equity costs. Once the amount of value has been calculated, targets for improvement can be set and shareholder value can be used as a measure for managing performance. What are the advantages of using SVA? Shareholder value analysis: • takes a long-term financial view on which to base strategic decisions; • offers a universal approach that is not subject to differences in companies' accounting policies and is therefore applicable internationally and across business sectors; • forces the organization to focus on the future and its customers, particularly the value of future cash flows. What to Do Obtain the Commitment of Top Management Underlying SVA is the belief that the creation and maximization of shareholder value is the most important measure of business performance. Top managers need to commit to this objective in order for the SVA approach to proceed and take root. They should also agree that traditional measures and approaches may not succeed in achieving this objective.

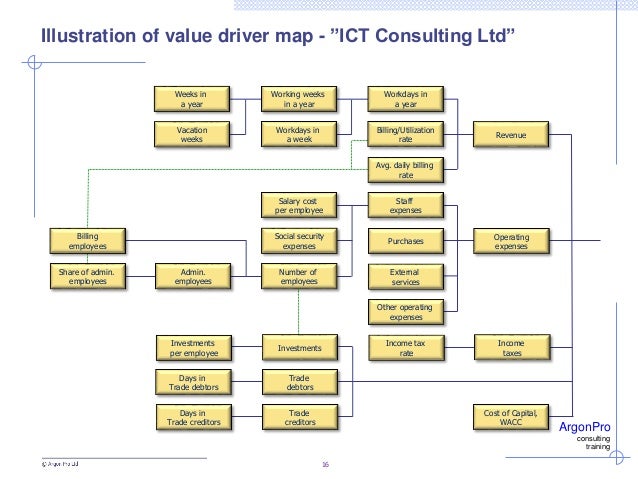

Understand and Calculate the Company's Shareholder Value Before adopting shareholder value as a significant financial objective, you need to understand its implications and the best way for your business to approach it. It can be helpful to first plan the approach with professional advisers such as accountants or consultants who specialize in this area. A company's value is calculated by subtracting the market value of any debts owed to the company from the total value of the business. The total value of a business has three main components: • the present value of future cash flows during the planned period; • the residual value of future cash flows from a period beyond the planned period; • the weighted average cost of capital. Total business value is calculated by adding present value of future cash flows to residual value of future cash flows and dividing it by the weighted average cost of capital.

If the result of this calculation is greater than one, then the company is worth more than the invested capital and added value is being created. • Future cash flows Future cash flows are affected by growth, returns, and risk.